Sales cost profit formula

Gross profit is the profit that a business makes after the manufacturing and selling costs are subtracted from the total sales. A profit and loss account is one of a companys financial statements that reflects the companys sales and expenditures over time.

Monthly Sales And Expenses Spreadsheet Summarizes Etsy Etsy Spreadsheet Sales Report Template Finance Infographic

Sales Formula Example 1.

. They apply the CVP analysis formula. Net Landed Cost Supplier Cost Duty charges Shipment charges specific to this producttotal units So now you have a clearer idea about how much you spent and what Selling price you should fix to get desired profit margin. Or Actual Profit Budgeted Profit.

Use the gross profit formula to find out the total gross profit ie Gross Profit Revenue - Cost of goods sold. Before spending a cent on CRM tools try out this 100 free and effective sales tracking template. You are required to calculate.

The formula to calculate. What is the Gross Profit Formula. After all revenues and expenditures have been accounted for it shows how the revenues are converted into net income or net profit.

Sales Margin Price Variance. Most businesses use a percentage. It represents the difference between the actual margin from sales valuing cost of sales at standard and the budgeted margin and can be calculated as follows Total Sales Margin Variance Actual Sales Standard Cost of Sales Budgeted Profit.

The ratio is computed by dividing the gross profit figure by net sales. Cost-Volume Profit Analysis. Gross profit Net sales Cost of goods sold 910000 675000 235000 Net sales Gross sales Sales returns 1000000 90000.

Also Operating Profit Margin Operating Profit Total Sales. A business generates 500000 of sales and incurs 492000 of expenses. The result of its profit formula is.

Gross Profit Margin Formula. The basic profit formula is expressed as Profit Selling Price - Cost Price. Her cost of goods sold is 325000.

Determine the cost of sales that the company has achieved on variable cost. Therefore we can use the below formula to calculate the cost of sales. Calculate Gross Profit Percentage Calculate Gross Profit Percentage Gross profit percentage is used by the management investors and financial analysts to know the economic health and profitability of the company after accounting for the cost of sales.

Total Landed Cost 20 4 x 20 200 x 25100 20 08 5 213 per unit. Out of the total 3 million toys were sold at an average selling price of 30 per unit another 4 million toys were sold at an average selling price of 50 per unit and the remaining 3 million toys were sold at an average selling price of 80 per unit. Cost of goods sold includes the.

The formula to calculate the gross profit is Gross Profit Total Sales revenue - Cost of goods sold. Guide to the Profit Formula. Net profit includes all the cost amount generated by the business as revenue.

Gross Profit Revenue Cost of Goods Sold. Here we discuss how to calculate the Profit along with practical Examples calculator and downloadable excel template. Rate of return on sales formula Revenue - Expenses Profit 600000 - 500000 100000 Profit Revenue Return on Sales ROS.

Cost price formula when profit percentage and selling price are given is. The formula to calculate gross profit margin as a percentage is. The sales turnover and profit during two years were as follows.

You are required to compute the cost of sales for inventory limited. The following formulaequation is used to compute gross profit ratio. Sales - Expenses Sales Profit formula.

An accurate sales budget is the key to the entire budgeting in some way. Example of the Profit Calculation. The last calculation using the mathematical equation is the same as the breakeven sales formula using the fixed costs and.

Target profit fixed costs contribution margin per unit projected sales 140000 14000 19 8105 Bountiful Blankets needs to sell 8105 blankets during the third quarter in order to meet their target profit goal of 140000. Her total revenue from sales is 400000 for the year. Cost-volume-profit CVP analysis is used to determine how changes in costs and volume affect a companys operating income and net income.

Iii Profit when sales are Rs. Let us take the example of a toy-making company that sold 10 million toys during the year. We are given opening stock closing stock and purchases.

As per the income statement the cost of sales selling administrative expenses financial expenses and taxes stood at 65000 15000 7000 and 5000 respectively during the period. Operating profit Gross Profit Operating Expenses. The company reported 230000 as of the opening stock 450000 as closing stock and 1050000 as net purchases.

You can calculate Gross Profit in Dollars with the following formula. Gross profit percentage formula Gross profit Total sales 100 read more. Typically it is expressed in both dollars and units of production.

I PV ratio ii Sales required to earn a profit of Rs. Free templates to track sales. You can increase sales at a small cost improving your return on sales ratio.

The profit formula is stated as a percentage where all expenses are first subtracted from sales and the result is divided by sales. A sales budget is a detailed schedule showing the expected sales for the budget period. Cost-volume profit CVP analysis is based upon determining the breakeven point of cost and volume of goods and can be useful for managers making short-term economic.

In performing this analysis there are several assumptions made including. The formula to calculate the Operating Profit is. If the sales budget is sloppily done then the rest of the budgeting process is largely a waste of time.

It represents the actual sum of money made by any business.

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Accounting Cost Of Goods

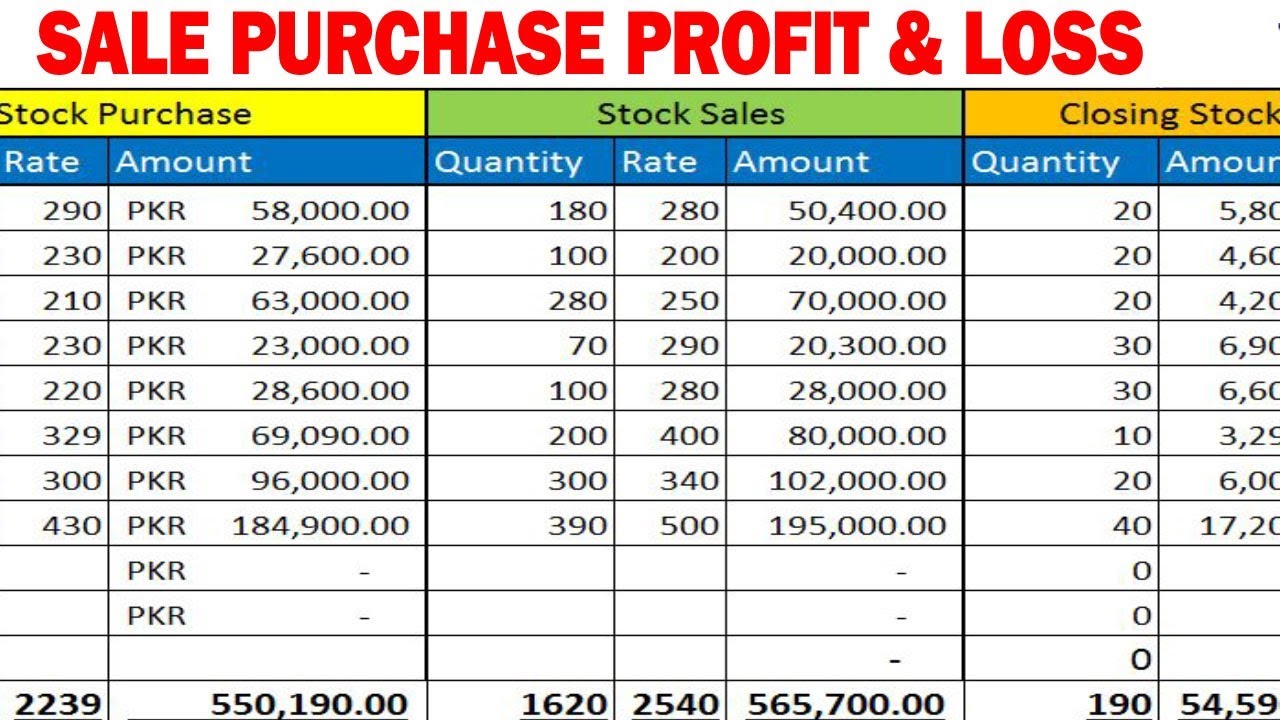

How To Make Stock Purchase Sales And Profit Loss Sheet In Excel By Lear How To Make Stock Learning Centers Excel Tutorials

Net Income Formula Calculation And Example Net Income Income Accounting Education

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

The Art Of Food Cost Control Bid Sheet Controlling Purchasing Chefs Resources Food Cost Food Truck Business Restaurant Business Plan

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Gross Profit Accounting Play Accounting Medical School Stuff Accounting And Finance

How To Calculate Gross Profit Margin 8 Steps With Pictures Profit Profitable Business Cost Of Goods Sold

Food Costs Formula How To Calculate Restaurant Food Cost Percentage Youtube Food Cost Restaurant Recipes Catering Food

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverage Also It Breaks Down Contribution Margin Sales Var

Operating Profit Margin Or Ebit Margin Profit Meant To Be Interpretation

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And T Contribution Margin Income Statement Cost Of Goods Sold

Profit And Loss Important Formulas Profit And Loss Statement Aptitude Loss

How To Calculate Selling Price From Cost And Margin Calculator Excel Development

How To Calculate Net Profit Margin In Excel Net Profit Profit Excel

Cost Of Goods Sold Formula Calculator Excel Template Cost Of Goods Sold Cost Of Goods Excel Templates

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Learn Accounting Economics Lessons