13+ can you get a fha loan with a judgement

You must make three consecutive monthly payments before FHA will insure a loan. In order to qualify for an FHA loan you should have at least 1 year of clean credit report.

The Shopper 8 7 13 By The Shopper Issuu

Judgments of a non-borrowing spouse in a community property state.

. An exception to the payoff of a court ordered judgment may be. An exception to the payoff of a court ordered judgment may be. Before approving a loan the lender analyzes the integrity of the borrowers past credit performance.

You cannot make a single payment of three months payment to satisfy this requirement. Judgments - FHA requires judgments to be paid off before the mortgage loan is eligible for FHA insurance. 13 can you get a fha loan with a judgement Minggu 30 Oktober 2022 Edit.

Based on FHA requirements those who. Credit Guidelines That FHA Lenders Follow. Borrowers can qualify for FHA Loan With Judgment either by paying off the judgment prior to or at closing.

And you must have made all those. August 31 2015. Tax liens fall into.

Prior to July 1. Yes you can get an FHA mortgage if you have collections items outstanding. However the FHA lender will check your.

Judgments - FHA requires judgments to be paid off before the mortgage loan is eligible for FHA insurance. The FHA VA mortgage lender must verify that court-ordered Judgments are resolved or paid off prior to or at closing. You may be able to get a FHA loan though you had a medical judgment on your credit report.

Can I Get An Fha Mortgage If I Have Judgments Collections And Federal Tax Liens. If you can get a 15 return for 5 years and later sell after 5 years and get 100000 in sales proceeds. Can you get an fha mortgage with tax lien and some judgements.

I agree with executivemortgageadvisor. We frequently handle reader questions in the comments section regarding FHA loan policies that affect borrowers going through a legal separation or divorce. Or by having a written payment agreement with the judgment creditor.

FHA loan with Chapter 13 bankruptcy To qualify for an FHA loan during Chapter 13 you need to be at least 12 months into your repayment plan.

Fha Credit And Your Fha Loan In 2022

Qualifying For Fha Loan During Chapter 13 Bankruptcy

Everything You Need To Know About An Fha 203k Rehab Loan

Collections On Your Credit Reports Can Hold You Back From Fha Loans

What Is An Fha Loan Ramsey

Fha Requirements Credit Guidelines

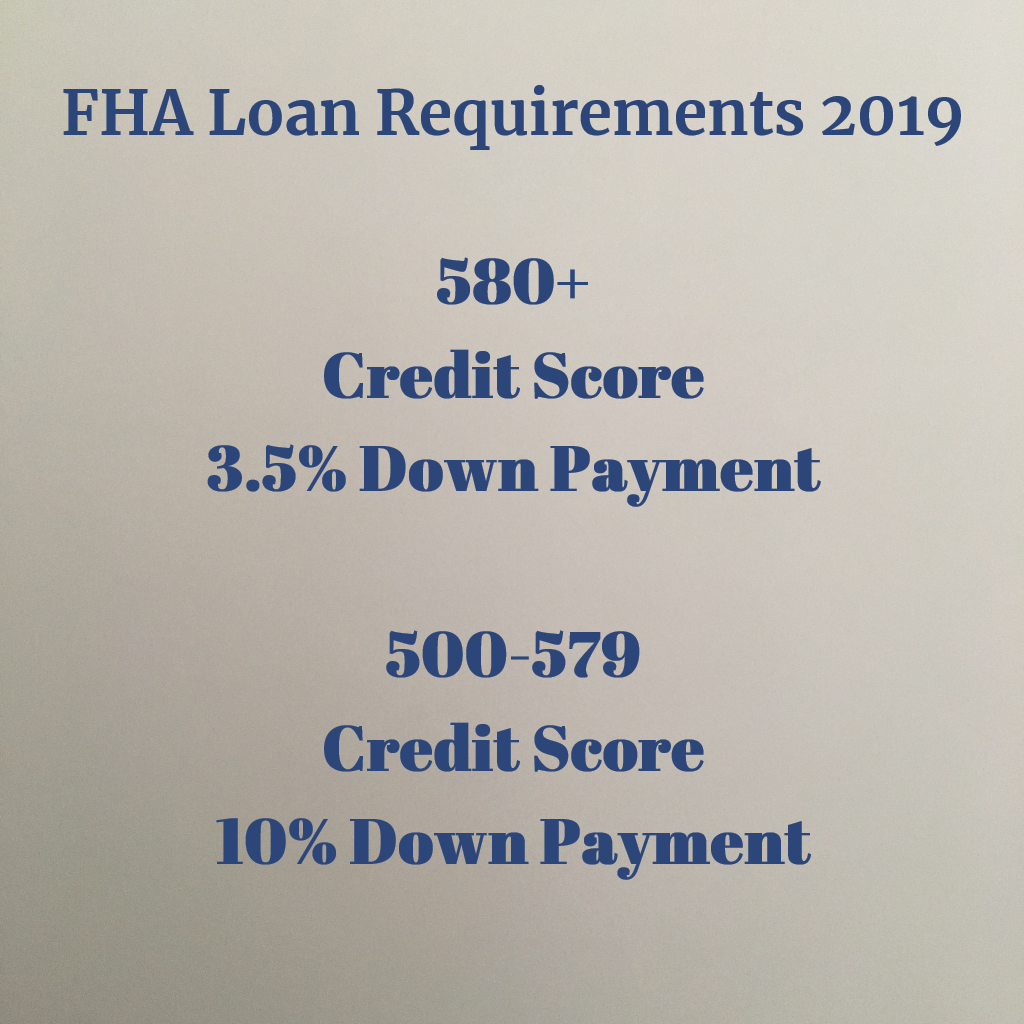

New Fha Guidelines 2019 Fha Loan Guidelines Credit Score And More

Fha Is Increasing Lending To Riskier Borrowers Housingwire

How To Get An Fha Loan Experian

Official Impostor Bitcoin Core To Drop To 0 In 2023 For Kraken Btcusd By Shelby3 Tradingview

Fha Requirements Credit Guidelines

Official Impostor Bitcoin Core To Drop To 0 In 2023 For Kraken Btcusd By Shelby3 Tradingview

Qualifying For Fha Loan With Judgment And Tax Liens

Qualifying For Fha Loan With Judgment And Tax Liens

How Do Fha Loans Handle Collections And Judgements The Heritage Group

Pros And Cons Of Fha Loans 8 Facts To Know For Veterans

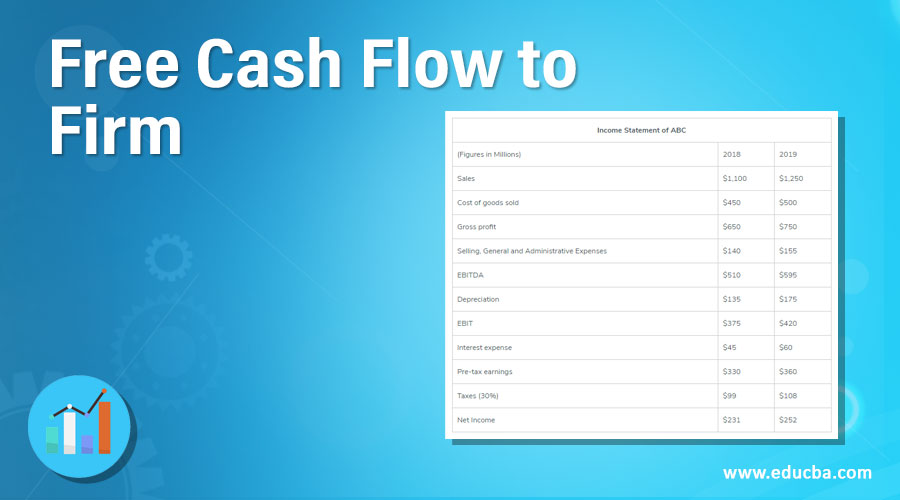

Free Cash Flow To Firm Examples Importants And Uses